tax service fee fha

A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. A tax service fee directly benefits the loan servicing company or the.

Understanding Closing Costs Sirva Mortgage

New Brunswick NJ 08901.

. This is a secure. What is a Tax Service Fee. Contact Our New Jersey Forensic Accounting Professionals for a Consultation.

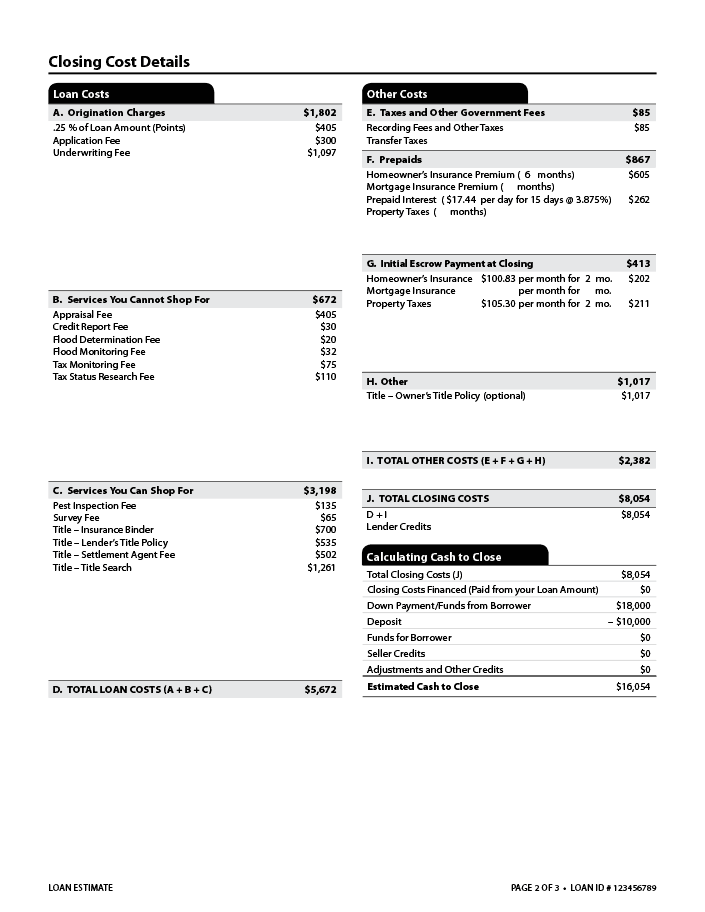

Find Us On Google Maps. The gist of the questioncan an FHA loan applicant be charged a tax service fee as part of closing costs or other loan-related fees and expenses. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and.

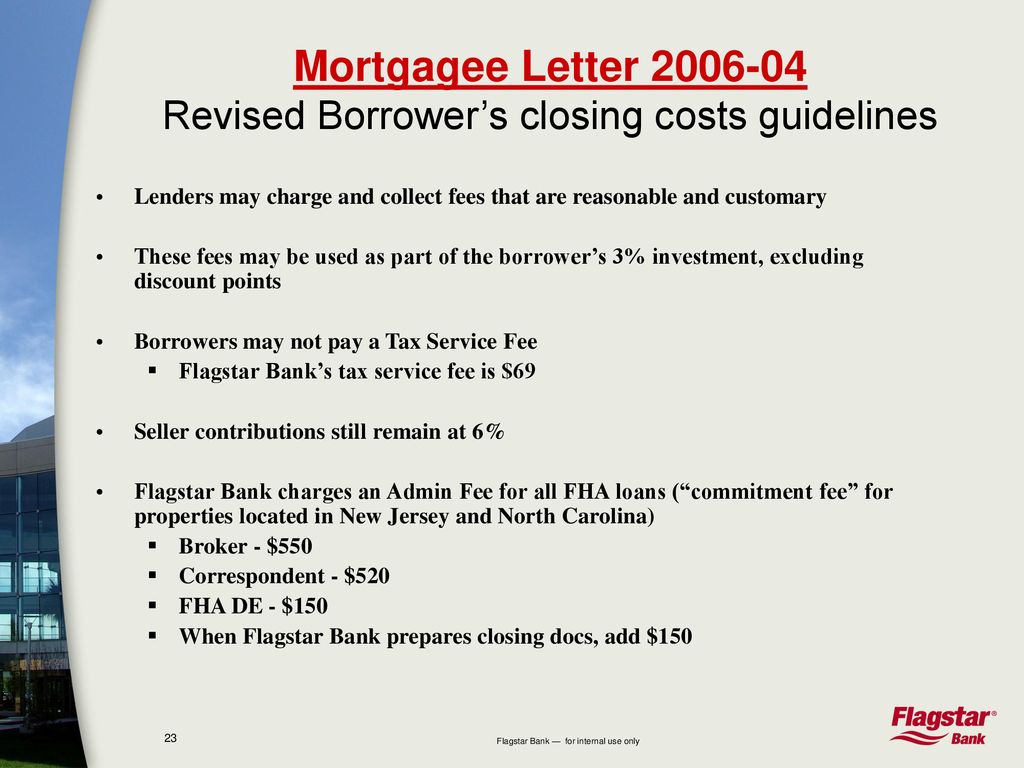

10000 Tax Appeal Estate Appraisals. FHA - Single Family. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay.

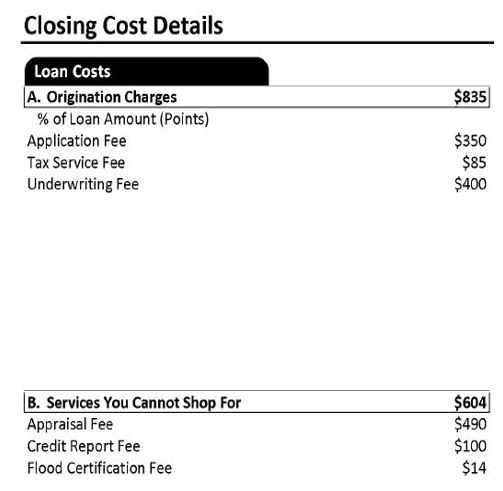

County Administration Building 4th Floor. FHA Lender Branch Office Application Fee Before You Begin Complete Agency Form Enter Payment Info Review Submit Confirmation About this form. Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner.

This lets you qualify for a mortgage with a low down payment possibly as little as 35 percent. What is a tax service fee FHA. FHA is adding the Third Party Property Tax Verification Fee to the list of allowable charges and fees that may be paid by the mortgagor.

Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been. The mortgage insurance you have to pay the. The one percent fee cap was eliminated for loans originated after that time but the FHA does not allow the.

For example in 2006 HUD changed its policy on non-allowable fees significantly reducing the number of items. To learn more about our NJ forensic accounting services contact us online or by phone at 908 322-7719. The catch is the FHA funding fees.

Can you charge a tax service fee on an FHA loan. The answer to this question. A tax service fee directly benefits the loan servicing company or the.

According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state. Simply put a tax service fee is paid to the company that services the loan. Office of the County Clerk - Registry.

The maximum fee must be a reasonable and. HUD noted that elimination of itemized. For loans through the end of 2009 the origination fee was limited to one percent.

Contact Us By Phone Text or Fax. For example in 2006 HUD changed its policy on non-allowable fees significantly reducing the number of items a borrower could not pay. But a fee for our services will.

Fha 203k Loan Renovation Mortgage Loans Explained

Loan Estimate Explainer Consumer Financial Protection Bureau

Fha Loan Down Payment Rules You Should Know Credit Karma

Fha Loans For Borrowers With Tax Debt Or Repayment Plans

Presenting The Fha Product Workshop Ppt Download

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

Hud Vs Fha Loans What S The Difference

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Fha Loan Requirements In 2022 A Complete Guide With Faqs Marketwatch

Fha Loans Houston Rock Mortgage Houston

What Costs Does The Seller Pay For An Fha Loan

Fha Vs Va Loans Similarities Differences Assurance Financial

Tax Preparation Services Options Costs For Filing Taxes

Mortgage Closing Costs 101 Arizona Real Estate

Refinancing An Fha Loan To A Conventional Loan Bankrate

U S Bank Home Mortgage Mrbp Nifa Housing Innovation Marketplace Conference Fha Updates January 25th Ppt Download

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

How To Prepare For Fha Appraisal Requirements A Complete Checklist Bankrate